What Channel Is Telemundo on Time Warner Cable

NEW YORK (TheStreet) -- "The combination of Time Warner (TWX) Cable and Comcast (CMCSA) - Get Comcast Corporation Class A Report (CMCSK) creates an exciting opportunity for our company, for our customers and for our shareholders," said Comcast CEO Brian Roberts.

But is it really?

The Time Warner-Comcast deal is expected to create a massive subscriber base of 30 million for Comcast, plus proceeds of $7.3 billion. That cash will come from Comcast's sale of cable systems with 1.4 million subscribers to Charter Communications (CHTR) - Get Charter Communications, Inc. Class A Report in order to gain regulatory approval for the Time Warner acquisition.

The merger places Comcast in the lead of the cable communication world. Let's look at whether the deal is worth it from a business and finance standpoint.

So what are the potential pitfalls?

1. Not focusing on the voice and video business

Cable TV is fast becoming a thing of the past. All the major TV providers lost a collective 113,000 subscribers in Q3 of fiscal 2013, with Time Warner Cable losing a whopping 306,000 TV subscribers. Tom Rutledge, CEO of Charter Communications, was "surprised" that 1.3 million of his 5.5 million customers opted out of the TV option.

In fact, the video and voice businesses have shown the slowest growth for Comcast, while Time Warner Cable's video and voice business shrank in 2013. It can be safely concluded that, with the massive $45.2 billion deal, Comcast was not looking to improve its cable TV business.

So, then, what is it looking for, and what does it stand to gain by the deal?

2. Net broadband subscriber growth is slowing

Time Warner Cable is a leader in deploying community Wi-Fi, with more than 30,000 hotspots, primarily in Los Angeles and New York City. The only effective step toward online video streaming is a far stronger presence as an Internet service provider. With the merger, Comcast mainly aims to magnify its market position in the Internet world. In fact, as reported last week, the company intends to put up 8 million Wi-Fi hotspots in the U.S. by the end of 2014.

But strangely, the net additions of broadband subscribers aren't doing much. Comcast added 1.16 million broadband subscribers in 2011 and 1.30 million in 2013.

Are U.S. Internet subscribers gradually moving on to better options? What's going on?

In truth, there are several other high-speed options available for U.S. Internet consumers these days. According to Pcmag.com, Verizon (VZ) - Get Verizon Communications Inc. Report Fios and Midcontinent are the top two Internet service providers when it comes to speed.

And fiber optic internet connections are progressively gaining market share in the United States. Google (GOOG) - Get Alphabet Inc. Class C Report (GOOGL) - Get Alphabet Inc. Class A Report fiber is gaining ground since the launch of Google fiber in Kansas City in March 2011. With the recent additions of Austin, Tex., and Provo, Utah, Google has already suggested 34 cities as candidates for future expansion. In January 2014, Netflix (NFLX) - Get Netflix, Inc. (NFLX) Reportfound that Google Fiber was the fastest Internet service, at an average rate of 3.45 megabits per second, followed by Cablevision (CVC) , at 2.39 Mbps, followed byCox, at 2.25 Mbps, and Suddenlink, at 2.19 Mbps.

There are other companies such as U.S. Internet and Cable One that are slowly climbing up the ladder. With almost 200 times faster Internet connections, along with almost a third of the price rates charged by the regular cable companies, fiber optic internet service providers might eventually take away the lion's share of the U.S. Internet market.

TheStreet Recommends

Investors should consider: will the Wi-Fi hotspot maneuver really do the trick for Comcast?

3. High debt and not enough cash in hand

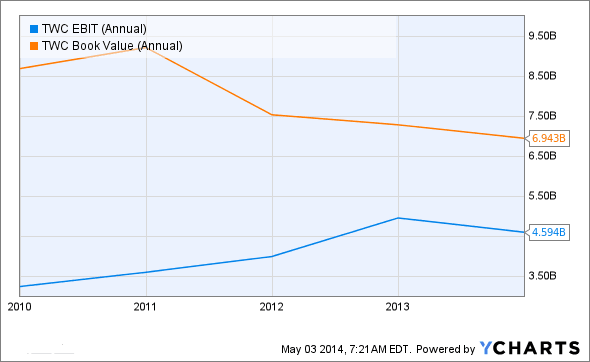

Time Warner Cable comes with $23.3 billion in long-term debt and only $525 million in cash, as reported in end of fiscal 2013. In addition to that, Comcast only has $1.7 billion in cash in hand. In fact, earnings before interest, taxes, depreciation and amortization for Time Warner Cable have been pretty stagnant over the last couple of years, with book value staying steady during that time.

All told, it looks like Time Warner Cable is not in peak condition.

Was buying Time Warner Cable really a good decision? I am doubtful. Let's look at some more numbers, though.

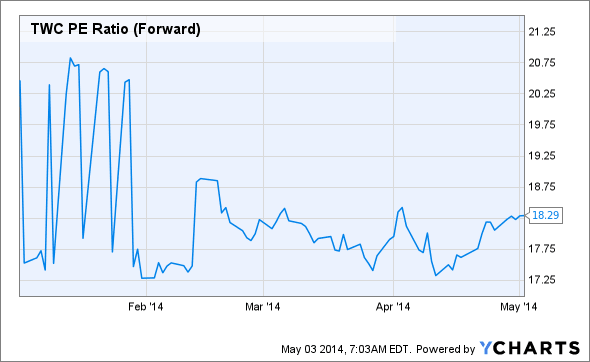

The price-to-earnings chart has been going down for quite some time, and looks to be headed down in the coming few years.

Comcast would likely have gotten a better price if it would have waited a bit more.

4. Further mergers in line

If this deal goes through, we can expect a few more acquisitions to go through as well. Google is already in talks with Dish Network (DISH) - Get DISH Network Corporation Class A Report on a new wireless service. AT&T (T) - Get AT&T Inc. Report is focusing on an almost-$40 billion acquisition deal with DirecTV (DTV) . Verizon is also not far behind, with its acquisition of Cincinnati Bell for $210 million on April 7.

In short, this looks to be the first big deal in a cable and telecom consolidation trend.

Considering the weak financial health of Time Warner Cable, the high price paid by Comcast and the stiff business competition likely to be experienced in the coming couple of years, I not thrilled about the Comcast-Time Warner Cable deal.

Investors should think seriously before buying into the hype here.

At the time of publication, the author held no positions in any of the stocks mentioned.

This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff.

What Channel Is Telemundo on Time Warner Cable

Source: https://www.thestreet.com/opinion/is-the-comcast-time-warner-cable-deal-really-a-good-idea-12696076